INVESTMENT STRATEGY

Cushon Core

Secure your financial future while making a difference.

Grow your savings

Automatically invested

Climate conscious

The Cushon Core is our secondary default investment strategy. This is where your savings are automatically invested if you do not make your own investment decisions. This is the case for most of our members.

You can find out if your organisation’s workplace pension is using Cushon Core in the NatWest Cushon app.

Capital at risk. The value of investments can fall as well as rise, and you may get less than the full amount you invest.

Investment performance

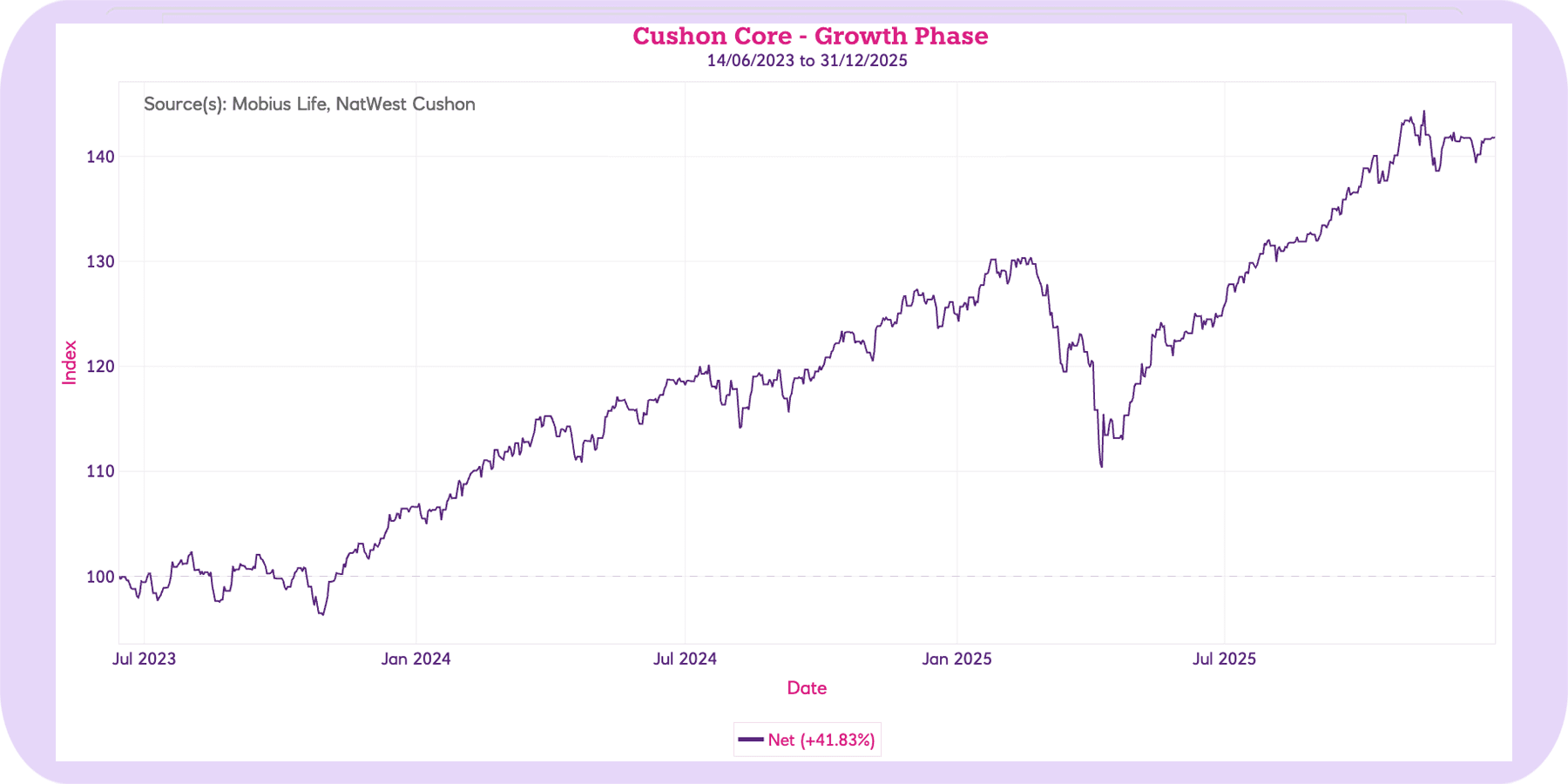

Cushon Core performance since inception to 31/12/25

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.

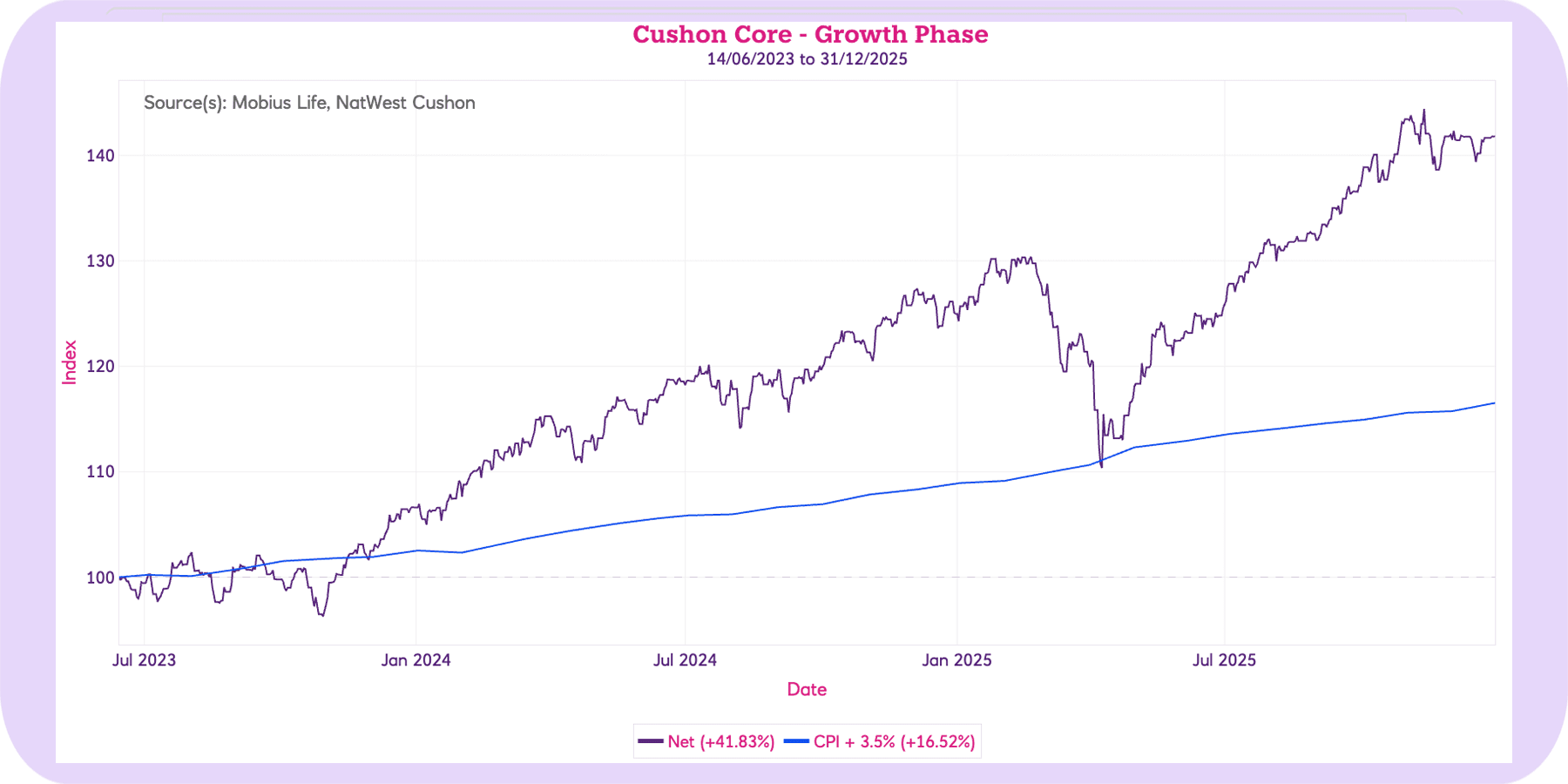

Cushon Core vs performance objective - since inception

Cushon Core aims to deliver returns of Consumer Price Index (CPI) + 3.5%.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.

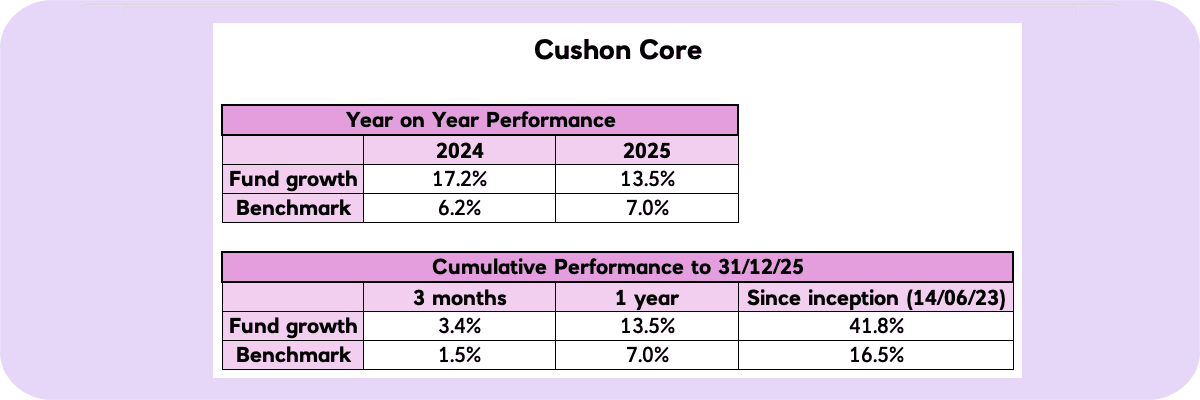

Cushon Core year-on-year performance since inception.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.

How this investment strategy is built

We use a combination of investment funds tailor-made for NatWest Cushon. Investment funds allow us to pool contributions from our members - which makes it the most cost-efficient way for you to invest.

90%

Cushon Global Equity

10%

Cushon Global Bonds

Target fund allocations for Cushon Core.

How we invest your money

In the growth phase of your pension, we invest your money using the following targets. They will vary from time to time as we optimally balance risk and returns.

90%

Global Equity Investment

10%

Global Bond Investment

Target asset allocation for Cushon Core.

More about these investments

90% of your pot is invested into stocks and shares of companies from around the world, in the Sustainable True Index managed by Macquarie. Your investments are spread across many regions and sectors, including familiar US technology giants like Apple, Microsoft and Alphabet, to some companies closer to home, like AstraZeneca and Tesco.

We co-designed this index ourselves by starting with a universe of over 3,000 companies, and excluding those that were not sufficiently aligned with the United Nations Sustainable Development Goals (UN SDGs). Roughly half of the companies did not meet our criteria, meaning our bespoke index consists of around 1,600 companies, favouring companies with green revenues, and away from carbon intensive companies. The index has an ongoing 7% emissions reduction target per year going forwards.

Despite having a much lower emission intensity, our index still tracks the performance of the FTSE All World extremely closely. We expect this outperformance to grow over time as the world transitions towards Net Zero.

10% of your pension pot is invested in global bonds. Instead of buying shares in a company, purchasing a company’s bonds means you are essentially giving them a loan. That entitles you to the principal (the amount loaned) and interest payments on that loan in return. Bonds are considered a lower risk, but also a lower return asset class compared to global equities. We spread your money so it’s not concentrated in a single type of investment.

We work closely with four different investment funds to manage our global bond portfolio:

NinetyOne Total Return Credit - 3.2%: This dynamic multi-asset credit strategy is designed to adapt to ever-changing market conditions. During uncertain times, it takes a defensive approach to protect your investments by lending to well-established companies with strong credit ratings. In more favourable market conditions, the strategy may shift to lending to growing, less mature companies, with the aim to capture a higher return on investment. The strategy is targeting at least 50% to be loaned to debtors that are achieving net zero, aligned to a net zero pathway, or aligning to a net zero pathway by 2030.

Wellington Global Impact Bond Fund – 2.5%: This is an impact fund, meaning investments are made with the intention to generate a positive, measurable social and environmental impact, alongside a financial return. The fund invests primarily in investment grade (safer) bonds, funding companies who seek to make a positive impact on themes such as clean water and sanitation, education and job training, and alternative energy.

Lombard Odier TargetNetZero Corporate Bond Fund – 2.5%: We recognise that decarbonising your portfolio does not necessarily lead to emission reductions in the real world; just because we are avoiding investing in high-emitting companies does not mean other investors will. To ensure we are creating a positive impact on real world decarbonisation, this fund aims to invest in companies which can contribute to a reduction in global carbon emissions and the eventual achievement of net zero carbon emissions by 2050. The fund targets companies that do not necessarily have low emissions today, but have credible decarbonisation strategies, and aims to assist them transition to a net zero world.

LGIM Future World GBP Corporate Bond Fund – 1.8%: The fund employs an index tracking strategy, aiming to replicate the performance of the Solactive L&G ESG GBP Investment Grade Corporate TR Index. The index aims to provide exposure to the GBP corporate bond markets while reflecting significant environmental, social and corporate governance (ESG) issues.

How Cushon Core works

When you’re younger, Cushon Core aims to grow your savings, also known as the Growth phase. Your portfolio has a higher allocation to typically “higher risk, higher return” assets such as global equities. Then, when you're 7 years away from first accessing your pension pot (we call this your Target Age), the way your money is invested starts to change automatically. We gradually move your savings towards typically “lower risk, lower return” assets such as bonds or cash, with the aim of protecting the value of your pension from bigger ups and downs in investment markets as you get closer to taking your pension.

If you don’t select a Target Age, it will automatically be set at 65.

How your investments change as you get nearer to your target age

In the 7 years before you begin accessing your pension savings, we will make changes to how your money is invested. This is called the ‘lifestyling phase’.

By telling us now how you think you’ll use your pension, we will change how your money is invested so it’s ready to pay out when you need it.

You can choose one of three pension lifestyle options.

- (One-off) lump sum payment

- Flexible income

- Guaranteed lifetime income

If we don’t hear from you, your money will automatically be invested assuming you’ll dip into your pension when you need to. This is flexible income (also known as flexible drawdown, flexi-access drawdown or income drawdown).

Lump sum payment

- Fully withdraw your pension – sell all your investments and take everything as cash

- Money in the bank – no longer tied to investment performance, you can see exactly what’s left

- Heavy income tax – anything above your 25% tax-free cash allowance will be taxed

Our sustainability credentials

At NatWest Cushon, we’re not only committed to securing your financial future, but also ensuring a sustainable world for you to retire into. As of 2023, the Cushon Core Investment Strategy (growth phase) has a carbon emission intensity that is 74% lower than our 2022 benchmark*. This means your pension savings are invested in a portfolio with significantly lower climate impacts, contributing to a healthier planet for everyone.

A climate-focused investment strategy is dual-purpose – we believe that aligning with future-proof investments is the best way to maximize your pot for retirement. As climate change reshapes the global economy, it will create clear winners and losers, and our goal is to position ourselves with companies that thrive in this new landscape. By investing in businesses that lead the transition to renewable energy, sustainable technologies, and responsible practices, we aim to capture growth opportunities while avoiding those companies that risk being left behind in industries that are no longer sustainable or competitive.

*2022 benchmark figure consists of the weighted emission intensity of our underlying fund’s benchmarks (118 t CO2e/$1m EVIC). In 2023, Cushon Core stood at 28 tCO2e/$1m EVIC, 74% lower than the 2022 benchmark.

Your money powers climate action

Shares and loans

We buy shares in or loan to companies that already have low and reducing emissions.

Companies

We invest in companies that need £ to activate their credible plan to reduce high emissions.

Influence

We use investments to directly influence companies to start their emissions reductions.

Other investment options

Risk Warnings

When you invest, there are always associated risks that you need to be aware of.

Investment risk: This is the risk that the value of your pension may go down as well as up. As with all investments, you may get back less than you paid in. It’s important to remember that your pension value can go down as well as up, even as you get closer to your Target Age. We will automatically move some of your investments to ones that are considered more cautious as you get closer to your Target Age to help protect the value of your pension from the bigger ups and downs in investment markets. However, we cannot offer any guarantees.

Investment objective risk: This is the risk that the Cushon Sustainable Investment Strategy might not meet its investment objectives which could mean your savings outcomes are not realised. The Cushon Sustainable Investment Strategy has been designed to meet the needs of most of our members, but this doesn't mean that it is suitable for your particular savings goals or that it will meet its objectives. It's important that you review your investments to make sure they align with your future plans.

Financial guidance and advice: Your choice of pension investments can have a big effect on your pot value at retirement. If you are in any doubt about which fund is right for you, you should speak to a financial adviser.

The value of investments can fall as well as rise, and you may get less than the full amount you invest.

Sustainable investments

Investment impact

Interview with Veronica Humble

Veronica Humble is Chief Investment Officer at Cushon. Her role is to guide the work of Cushon's investment team, who make day-to-day decisions about where members' pension money is invested.

NatWest Cushon

Investment impact

Putting money where it's fit for the future

Unless you make your own investment decisions, your pension savings will be invested according to our Cushon Sustainable Investment Strategy. This uses many different types of investments, to give your money the opportunity to grow over the long term.

NatWest Cushon

Investment impact

Powering the UK's renewable electricity

Cushon members are helping to finance over 100 sites across the UK that are producing renewable energy now or are set to begin production in the near future. These are mainly made of solar arrays and wind turbines, both onshore and offshore.

NatWest Cushon

Investment impact

Growing low-carbon veg in the UK

Your pension savings are helping to grow fresh food closer to home, using energy that would otherwise go to waste.

NatWest Cushon