NATWEST CUSHON FOR INDIVIDUALS

Making your pensions and savings easy

NatWest Cushon makes it easy to take control.

Simple and easy to use

Stay in control of your finances with friendly insights and helpful nudges

Everything in one place

Track the progress of your savings and pension via app or web

Invest with climate impact

Our climate focused workplace pensions naturally prioritise financial returns for you

Super-smart saving

Help your savings pot grow with the help of our 24/7 savings buddy for Stocks and Shares ISAs

Capital at risk. All NatWest Cushon ISA products are Stocks and Shares ISAs. The value of investments can fall as well as rise, and you may get less than the full amount you invest.

Getting started with NatWest Cushon is easy

However you're saving

Workplace pensions

Easy to use pensions that power positive climate impact. Capital at risk.

Workplace ISAs and savings

Save towards your financial goals, direct from your salary. All NatWest Cushon ISAs are investment-based. Capital at risk.

Personal savings

Whatever you are saving for we can help with ISAs and general savings solutions. All NatWest Cushon ISAs are investment-based. Capital at risk.

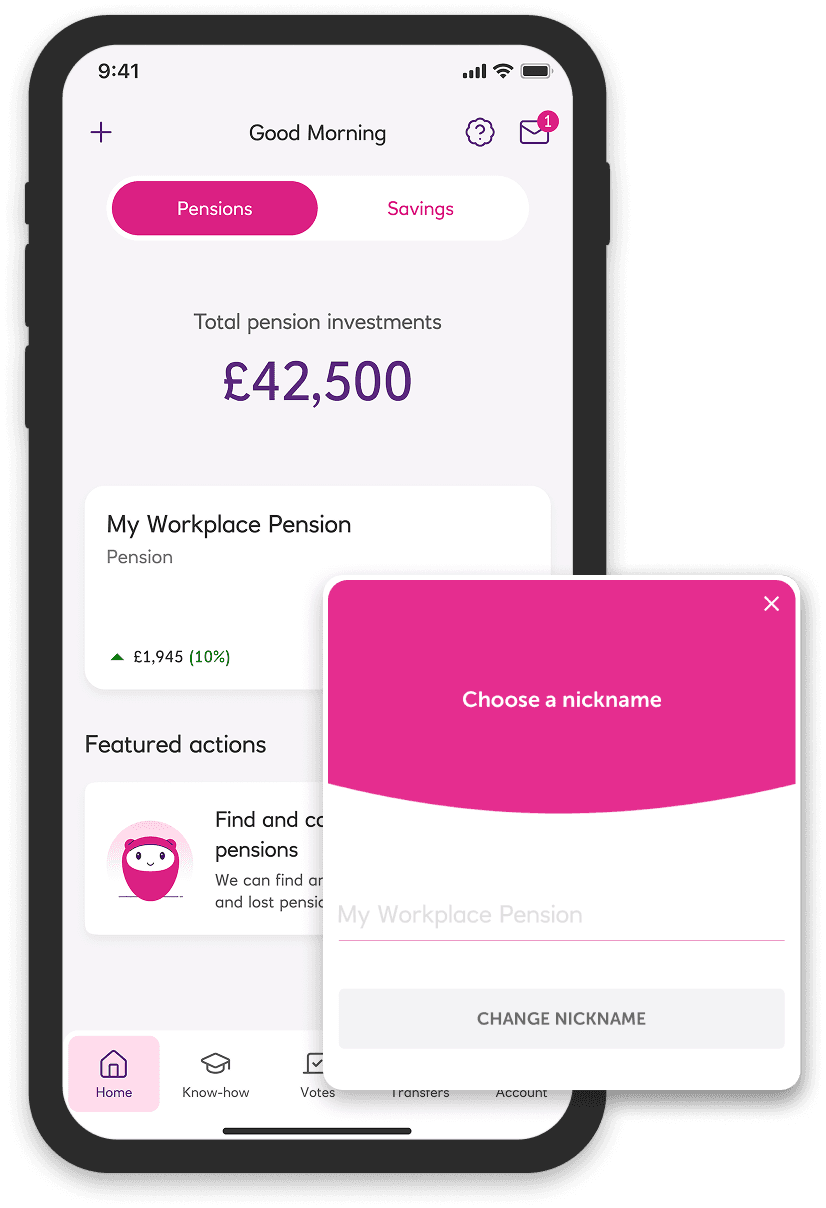

Simple and easy to use

Stay in control of your workplace pension and savings with our friendly app.

- View, manage and withdraw money

- Regular emails to confirm what's being paid in

- See how changes to your contributions could affect what you get out

The figures shown are for illustrative purposes only

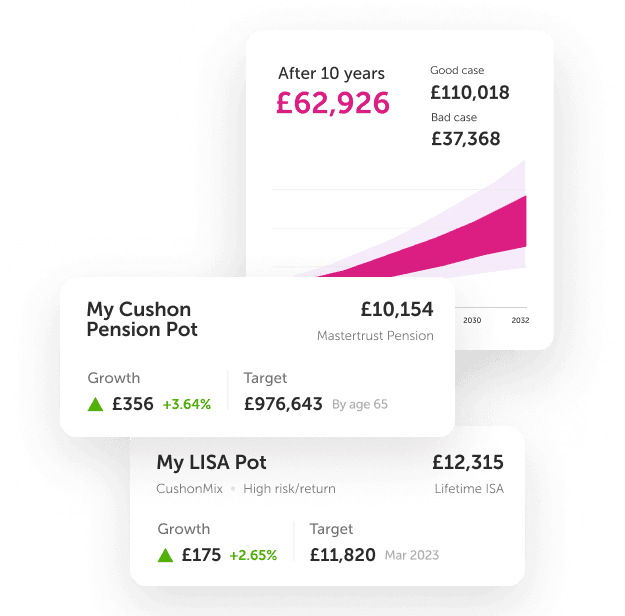

The figures shown are for illustrative purposes only

Everything in one place

Cut down the number of logins and accounts you need to keep on top of your finances.

- Keep track of your pension, workplace savings and personal ISAs in one place

- Transfer your existing pensions with our help and support

- Check your finances any time via the app or log in on the web

Invest with climate impact

Naturally prioritising financial returns for you, our climate focused workplace pensions are also designed to protect the future you retire into.

- We have already reduced our CO2 emissions by 78% [¹]

- We are targeting an 80% reduction by 2030 [²]

- Investing in real world impact such as low carbon energy, sustainable social housing and habitat protection

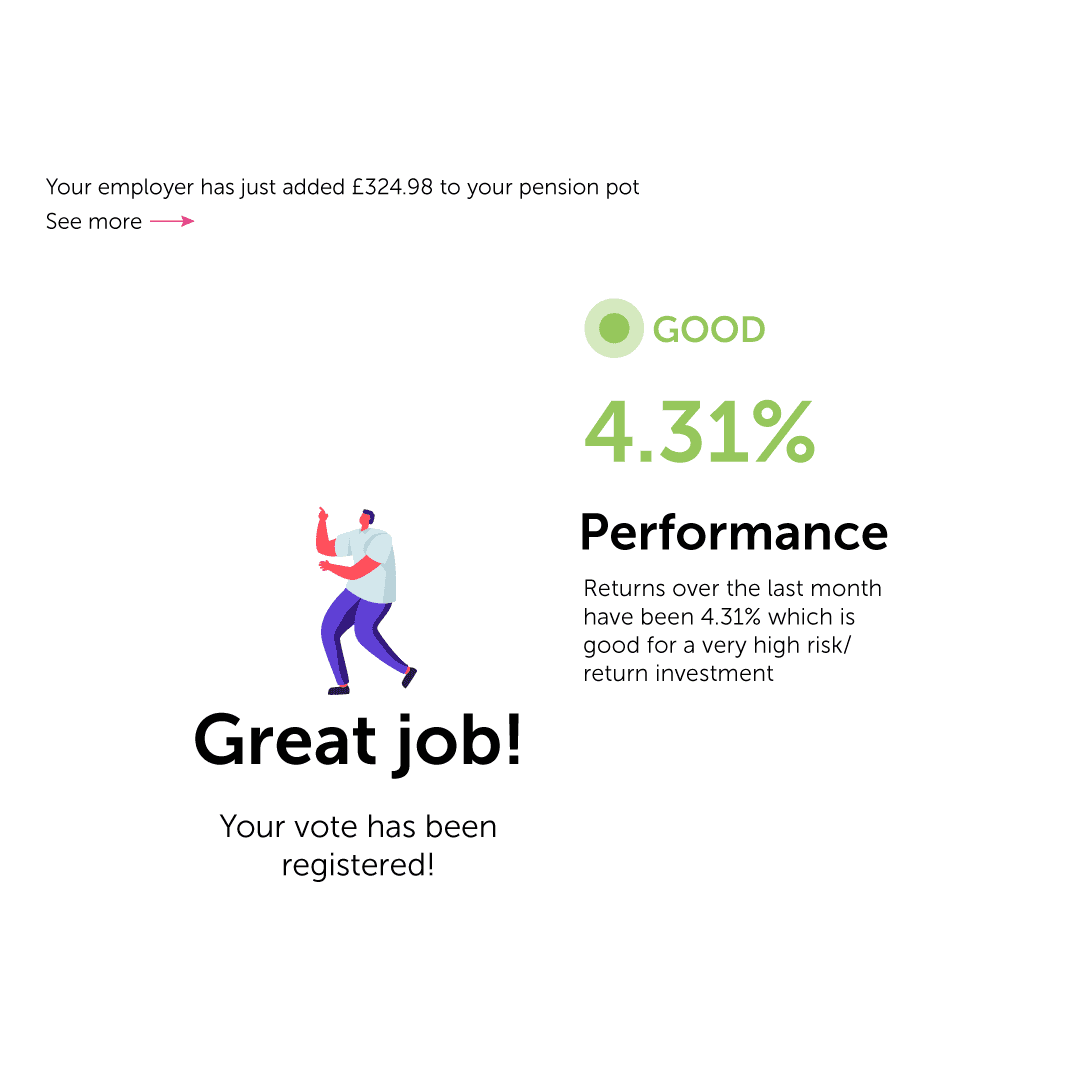

The figures shown are for illustrative purposes only

Super-smart savings buddy for Stocks and Shares ISAs

Our algorithm is a 24/7 savings buddy for Stocks and Shares ISAs.

- Monitors 1,000s of funds and highlights opportunities for better returns

- Friendly insights and suggestions

- Choose from four ready-made portfolios with different levels of risk

- Invest in line with your ethical priorities

Getting started with NatWest Cushon is easy. Get set up in minutes

People building a different future with NatWest Cushon

Trusted by over 600,000 members who have some great things to say.

You may also like...

Blogs

Your A to Z of workplace pensions

Getting the hang of pensions can feel as tough as learning a language. With every new letter or email comes a new technical term or abbreviation. It’s exhausting! But it’s also important.

NatWest Cushon

Blogs

What replaced the pension lifetime allowance and what changed for employees?

Tax-free allowances are one of the best things about pensions, helping employees save more for less. But what are the rules in 2024? Instead of the old lifetime allowance (or “LTA” for short), we now have new acronyms: the LSA and LSDBA. WTH are they?

NatWest Cushon

Blogs

42% of people don’t think they are saving enough

We’ve been thinking a lot about financial resilience lately. Being financially comfortable and how this means different things to different people.

NatWest Cushon

Blogs

Cushon Master Trust vs deforestation

Forests are a critical piece of the global ecosystem, covering about 31% of Earth's land area and playing a vital role in maintaining environmental stability. They act as the planet's lungs, absorbing approximately 2.6 billion tons of carbon dioxide annually, helping to regulate climate and mitigate global warming.

NatWest Cushon

Frequently asked questions

There's no charge for employers.

Members pay an Annual Management Charge or 'AMC'. This is a small percentage starting at 0.69% and depends on the investments they select.

No. We are open to all organisations of all sizes.

If you've just hired your first employee, you'll need a workplace pension to comply with your auto enrolment duties - so we've made it easy to apply.

Most applications only take a few minutes.

If you're short for time, we only need some information about you and your company to save your application in case you need to return to it later.

We need information that you will already know about you and your organisation.

This includes information about you, your organisation, who will be running your workplace pension and when you want it to start.

Very safe.

Cushon Master Trust is authorised and regulated by the Pensions Regulator. Members' savings are legally protected by a trust management. We are chosen by employers across the UK to help their employees confidently save for the future.

Importing employees and contributions into your payroll through the Cushon Employer portal couldn't be easier. We have created a guide to help you understand the supported file formats and the upload process.

You can download the NatWest Cushon app on the Apple App Store or the Google Play Store. Alternatively, you can access our member portal.

If you have a pension with us and are logging in the app for the first time, you'll need the unique 6-digit one time access code that has been sent to you in your Welcome Pack.

For your pension account, this is your National Insurance Number.

Forgotten your password? Click here and follow the simple steps to get a new one.

[¹] Reduction in scope 1 and 2 carbon emissions for the growth phase of Cushon's Sustainable Investment Strategy since inception (August 2022), compared to its independently verified 2022 benchmark. The benchmark, which has been verified by independent advisers ISIO, is defined as the weighted average of the carbon footprint of the underlying funds’ benchmark of 118 tCO2e/$m EVIC. For further information, see our Task Force on Climate-Related Financial Disclosures (TCFD) Report.

[²] Target for the growth phase of Cushon's Sustainable Investment Strategy to achieve a in scope 1 and 2 carbon emissions by 30th September 2030, compared to its independently verified 2022 benchmark. The benchmark, which has been verified by independent advisers ISIO, is defined as the weighted average of the carbon footprint of the underlying funds’ benchmark of 118 tCO2e/$m EVIC. For further information, see our Task Force on Climate-Related Financial Disclosures (TCFD) Report.